Hmmm...

A difficult question to answer but one I'm asked quite a lot.

Before having a go at answering this particularly thorny question I need to go back a little bit to explore the nature of 'price'.

First things first, then.

There is no such thing as cheap or expensive. There is only value for money or not value for money... whether someone can afford something is an entirely different issue.

For example, I quite like cars and I quite like Bentley Continentals. There's a Bentley Continental GT Speed for sale at the moment which starts from £168,900.

Is this cheap or expensive?

Well, in my heart of hearts I know that it's pretty good value for money (although other opinions may differ) and if I had the money I would buy one.

But I don't have the money, so I can't buy it in any case. Does that mean it's expensive? No... it just means I can't afford it.

And it's the same with your accountant - are they cheap or expensive?

Well, neither, actually. They're either providing you with good value for money or poor value for money.

So the question is not is your accountant expensive, it's what's good value for money?

Here we get into the realms of opinion. Just as I think the Bentley Continental GT is good value for money others will think it's a monumental waste of dosh - why on Earth would anyone spend such a vast amount of money on something that does the same job as a car that cost, say £20,000... or £10,000?

It all depends on what you're looking for in your car or accountant. For me, what I believe to be good value for money is an accountant who is proactive - who contacts you with relevant information or ideas or suggestions for changing things around.

I also think good value for money is an accountant who charges a fixed fee that doesn't vary if you call a couple of times a month, or you pop into their office. And don't think this is entirely altruistic... it's a win-win. If you ask your accountant's opinion of for advice and they are able to help you out it just means there's one less thing for them to sort out at the end of the year.

Finally, I think good value for money is transparent. You should know what you're paying up front and there should be nothing hidden because then you can budget correctly for period ahead.

Monday 5 December 2016

Wednesday 2 November 2016

Our New App - Using the Mileage Calculator

Last time round I talked you through how to record an expense using our new app.

This week I'm going to show you the mileage calculator which, personally, I think is ace.

If you haven't already, you'll need to download our app. It's completely free and you don't need to be a customer to do it... you can use all the features to make your life easier.

To download you can visit either the App Store or Google Play and search TaxAssist Awesome (hmmm... that app developer with a sense of humour!

Alternatively you can follow either of these links to get to the right place:

App Store

Google Play

So - to the Mileage Calculator...

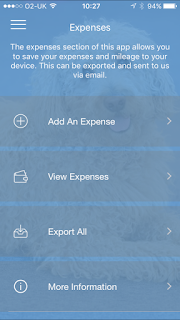

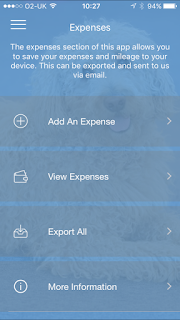

Open up the app and either click on the expenses picture on the front screen or tap expenses from the menu.

You'll get this screen:

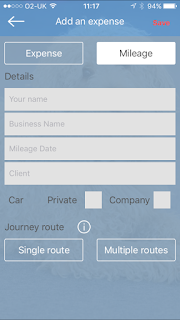

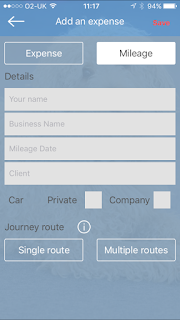

Tap 'Add An Expense' and at the top of the screen you'll get two options: Expense or Mileage. Given we're talking about mileage, have a guess at which one you need to need to tap... yep, you're quite right.

This will bring you through to the first screen of the Mileage Calculator which looks like this.

You need to add a few details. Your name you just need to type in once and the app will remember you. You have the option of adding your company name - it's up to you.

Tap on 'Mileage Date' to bring up a calendar so you can add the day the journey took place. You can add journeys for any date but we suggest you do it on the day you make the journey - just so you remember to claim everything you're due.

You also have the option of adding the client you are working for - but it is just an option.

You then have a couple of choices. Tap the box for either Private or Company car and choose either Single or Multiple Route.

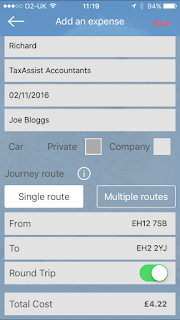

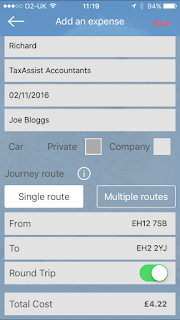

Single Route is simply point to point - you leave, you arrive. When you select this option you'll be asked whether this was a return journey - if it was the app automatically calculates both journeys; there and back.

Multiple Route allows you to add a number of journeys in one entry. Perhaps you are travelling from one job to another and then home at the end of the day. These 'legs' to your journey can be made as one entry.

Here's an example of a completed page:

Simple!

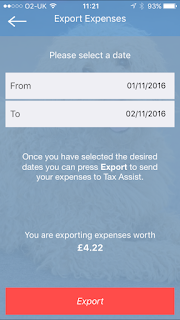

It's okay getting information in but how do you get it out again?

Well, that's easy, too.

Have a look at the first screen shot again.

See where it says 'Export All'.

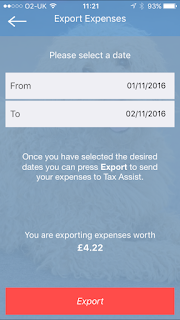

Click on that and this is what you'll see:

Select the date range (we suggest once a month) and hit the red button that says 'Export'.

This creates a spreadsheet and will open up your email on your 'phone. The default email is to us but you can change it to send the spreadsheet to yourself (or your own accountant if you'd like) ready to complete your VAT return, expenses claim or your year end accounts.

We'll even send you a reminder to download info via the app.

It really is that simple.

If you've downloaded the app and you want some help with the expenses module feel free to pop in or give me a call. Here are the contact details:

Corstorphine: 0131 202 9888

Dunfermline: 01383 665 666

Goldenacre: 0131 322 3988

This week I'm going to show you the mileage calculator which, personally, I think is ace.

If you haven't already, you'll need to download our app. It's completely free and you don't need to be a customer to do it... you can use all the features to make your life easier.

To download you can visit either the App Store or Google Play and search TaxAssist Awesome (hmmm... that app developer with a sense of humour!

Alternatively you can follow either of these links to get to the right place:

App Store

Google Play

So - to the Mileage Calculator...

Open up the app and either click on the expenses picture on the front screen or tap expenses from the menu.

You'll get this screen:

Tap 'Add An Expense' and at the top of the screen you'll get two options: Expense or Mileage. Given we're talking about mileage, have a guess at which one you need to need to tap... yep, you're quite right.

This will bring you through to the first screen of the Mileage Calculator which looks like this.

You need to add a few details. Your name you just need to type in once and the app will remember you. You have the option of adding your company name - it's up to you.

Tap on 'Mileage Date' to bring up a calendar so you can add the day the journey took place. You can add journeys for any date but we suggest you do it on the day you make the journey - just so you remember to claim everything you're due.

You also have the option of adding the client you are working for - but it is just an option.

You then have a couple of choices. Tap the box for either Private or Company car and choose either Single or Multiple Route.

Single Route is simply point to point - you leave, you arrive. When you select this option you'll be asked whether this was a return journey - if it was the app automatically calculates both journeys; there and back.

Multiple Route allows you to add a number of journeys in one entry. Perhaps you are travelling from one job to another and then home at the end of the day. These 'legs' to your journey can be made as one entry.

Here's an example of a completed page:

Simple!

It's okay getting information in but how do you get it out again?

Well, that's easy, too.

Have a look at the first screen shot again.

See where it says 'Export All'.

Click on that and this is what you'll see:

Select the date range (we suggest once a month) and hit the red button that says 'Export'.

This creates a spreadsheet and will open up your email on your 'phone. The default email is to us but you can change it to send the spreadsheet to yourself (or your own accountant if you'd like) ready to complete your VAT return, expenses claim or your year end accounts.

We'll even send you a reminder to download info via the app.

It really is that simple.

If you've downloaded the app and you want some help with the expenses module feel free to pop in or give me a call. Here are the contact details:

Corstorphine: 0131 202 9888

Dunfermline: 01383 665 666

Goldenacre: 0131 322 3988

Wednesday 19 October 2016

Using Our App

Our new app has all the things you'd expect from an app...

Funny pictures of the team, useful documents in a library, calendar, telephone numbers and so on.

But the the thing we're most proud of is the Expenses Module.

The Expenses Module allows you to keep track of your day to day expenses and your mileage... and it's all completely simple.

Here's an example.

First thing first - you need to download the app which you can do from the App Store or Google Play by searching TaxAssist Awesome. (I know, I know - an app developer with a sense of humour!

You can get into the Expenses Module in one of two ways.

Ont he front page of the app there's a box called 'Expenses' - tap this. Or int he top left hand corner of the screen there are three lines. Tap on these and a menu opens - the Expenses Module is listed fairly near the bottom of your screen. Just tap on the word.

Once you've done this, the Expenses Module opens.

To Add an Expense

Tap 'Add and Expense'.

The first time only you'll need to add your name - either yours or your business. Once you've done this tap on each white box to complete the process:

Funny pictures of the team, useful documents in a library, calendar, telephone numbers and so on.

But the the thing we're most proud of is the Expenses Module.

The Expenses Module allows you to keep track of your day to day expenses and your mileage... and it's all completely simple.

Here's an example.

First thing first - you need to download the app which you can do from the App Store or Google Play by searching TaxAssist Awesome. (I know, I know - an app developer with a sense of humour!

You can get into the Expenses Module in one of two ways.

Ont he front page of the app there's a box called 'Expenses' - tap this. Or int he top left hand corner of the screen there are three lines. Tap on these and a menu opens - the Expenses Module is listed fairly near the bottom of your screen. Just tap on the word.

Once you've done this, the Expenses Module opens.

To Add an Expense

Tap 'Add and Expense'.

The first time only you'll need to add your name - either yours or your business. Once you've done this tap on each white box to complete the process:

- Date of Expense - this brings up a calendar. We suggest you add an expenses as soon as it's incurred

- Supplier - just a short description. So if it's your lunch, for example, just type 'Greggs'. (Other sandwich shops are available!)

- Category - this will bring up a menu - simply select the expense type. For your lunch it would 'Travelling expenses'

- Amount - add in the amount. This is the total you paid including any VAT which is specified on your receipt

All good so far?

Here comes the really clever bit.

If there's VAT applied to whatever you've bought tap 'Yes' box to the next question. If there isn't, tap 'No'.

It doesn't matter whether you're VAT registered or not yourself. Confirming that VAT has been paid will simply separate the VAT element out on the CSV file that gets sent to us.

Finally, if you have the receipt tap the final box 'Yes'. You will then be prompted to take a photo of the receipt. The app then attaches the photo to the expense.

You can throw the receipt away.

Finally, finally REMEMBER TO TAP 'SAVE' IN THE TOP RIGHT HAND CORNER!

Choices

Once you have a number of expenses you might want to submit them to someone.

If we're looking after your bookkeeping, accounts or your personal tax return you'll need to send your expenses to us.

You can do this once a month, quarterly once a year... whenever.

And it's really easy to do.

Back on the front page of the Expenses Module click on the button that says 'Export All'.

You will be prompted to select a date range for the expenses you wish to export.

When you've entered the date range you need, tap 'Export'. The default email where your expenses will be sent is us... but you can change that to whatever email address you want.

So, you could send the expenses spreadsheet to yourself for your own records!

Next week, I'll talk you through the Mileage Calculator... which is brilliant, too. Of course, feel free to get in touch if you'd like some help with it before next week.

0131 202 9888.

To download our app visit the App Store or Google Play:

To download our app visit the App Store or Google Play:

Wednesday 12 October 2016

Mortgages

Pretty often, in the past, we've been asked if we 'do' mortgages.

'Well, no...' we always replied, because we didn't 'do' mortgages; we simply referred on to other people.

Then, one day, a customer of ours called us in a state of what I can only call apoplexy.

Not at us, fortunately... but at his mortgage broker.

He'd just learned that he'd been turned down for a mortgage because of his situation. Essentially his situation is that he's a director of a limited company, pays himself a small wage and takes dividends for the rest.

Standard stuff, but the mortgage broker didn't understand this, submitted an application based a very small wage without explaining the full circumstances and lo and behold, his client got rejected.

Painful... and not a nice conversation for us to have, either, even though it was nothing to do with us per se.

But we have this rejection to thank for what we did next.

Find My Mortgage is a new mortgage broker based in our offices in Corstorphine, Dunfermline and Goldenacre.

You can find out a bit more about the business here: https://www.facebook.com/findmymortgage/

Here are the essentials.

Find My Mortgage is run by Neil Johnston. The FMM philosophy is simple - to make finding the right mortgage for any given set of circumstances as easy and as stress free as possible... they would even go as far as saying 'enjoyable'!

And this philosophy runs through everything Neil and Richard do. From the very simple things - you won't find a pin striped suit nor a a tie between them - to the more fundamental.

For example, how they get to know you and your circumstances, what you're trying to achieve and what would work best for you.

Find My Mortgage has access to the whole of the mortgage market and they can help you find the right mortgage quickly and efficiently.

So, here's what we would really love... if are thinking about:

'Well, no...' we always replied, because we didn't 'do' mortgages; we simply referred on to other people.

Then, one day, a customer of ours called us in a state of what I can only call apoplexy.

Not at us, fortunately... but at his mortgage broker.

He'd just learned that he'd been turned down for a mortgage because of his situation. Essentially his situation is that he's a director of a limited company, pays himself a small wage and takes dividends for the rest.

Standard stuff, but the mortgage broker didn't understand this, submitted an application based a very small wage without explaining the full circumstances and lo and behold, his client got rejected.

Painful... and not a nice conversation for us to have, either, even though it was nothing to do with us per se.

But we have this rejection to thank for what we did next.

Find My Mortgage is a new mortgage broker based in our offices in Corstorphine, Dunfermline and Goldenacre.

You can find out a bit more about the business here: https://www.facebook.com/findmymortgage/

Here are the essentials.

Find My Mortgage is run by Neil Johnston. The FMM philosophy is simple - to make finding the right mortgage for any given set of circumstances as easy and as stress free as possible... they would even go as far as saying 'enjoyable'!

And this philosophy runs through everything Neil and Richard do. From the very simple things - you won't find a pin striped suit nor a a tie between them - to the more fundamental.

For example, how they get to know you and your circumstances, what you're trying to achieve and what would work best for you.

Find My Mortgage has access to the whole of the mortgage market and they can help you find the right mortgage quickly and efficiently.

So, here's what we would really love... if are thinking about:

- Moving house or buying your first home

- Reviewing or renewing your Buy to Let mortgage (whether it's fixed rate or variable interest)

- Consolidating some debts into one loan

- Building an extension for which you need to borrow some money

Please do give Find My Mortgage a buzz on 0131 441 1000.

Friday 30 September 2016

How to Choose an Accountant

I do recognise that I may be biased but I have some pretty clear ideas about accountants, how to choose the right one for you and what your accountant should do for you.

So I thought I'd write about it and you can make your own mind up about my potential bias.

Let's get cracking, strangely, with what accountants shouldn't be doing to encourage you to sign up with them...

What they shouldn't be saying is something along the lines of 'Come to us because the accounts we produce will be accurate...'

That's a bit like going into a motor dealership and the sales person saying 'Buy this car, all four wheels are entirely round...'

I mean, when you think about it, what's the alternative? A car with three round wheels and a square one? An accountant who produces inaccurate accounts?

Accurate accounts are the minimum that any customer should expect. After all, the end product - a tax return, VAT figure or set of accounts - should all be the same, notwithstanding interpretation of the rules and the odd mistake. They all come from the same raw materials: the records provided by the customer.

How do you make a choice, then? Because, unless an accountant explains why they're the best choice for you and/or your business there's only one thing that will really drive your decision: price.

And we all know cheap does not mean the best.

To help make the choice here are my top six tests for choosing an accountant:

- First and foremost, do you actually like the accountant you are thinking about signing up with? After all, you might well be asking them for advice... and even better, they could actually be proactive and call you with some ideas. If you get on well with your accountant, you have a good relationship with them, then you are more likely to receive relevant advice because the accountant knows more about you and you are more likely to respect (and take) the advice given.

- Will you have a named contact - someone who you can build a day to day relationship with so you know who to call and you don't have to explain the same things over and over again? Of course, it's not always possible to speak to the same person every time (they might be allowed holidays) but in general terms it really helps.

- It may sound a little silly but do you actually like going into the office? Are the people friendly and do they seem genuinely pleased to see you. A lot of practices measure their staff in chunks of time and so they don't have time to invest in a bit of banter... once again, if you enjoy visiting your accountant's office you are more likely to on a regular basis and you are more likely to get the advice you are looking for.

- Are your fees fixed? If you are charged by time this can make things difficult - you might not know how much you are actually going to be charged and it might make you more reticent about calling or visiting...

- Is your accountant investing in technology? Do they have their own app for completing expenses claim forms, for example? Do they promote a cloud based bookkeeping system such as QuickBooks? And here's another easy test - do they have two screens on every desk? If they do they are probably investing in technology which is very, very important.

- And finally, do you get the impression they want you to succeed? It's a bit difficult to tell, but if you asked would they put your business card out in their office? Do they invite you to networking events from time to time? If you asked them for a recommendation to another business, do you believe they would be able to do it?

Ultimately, of course, the choice depends on what you, the customer want and need from your accountant, so if the person your sitting in front of you asks 'What are you looking for from your accountant?' You're probably onto a winner!

Thursday 4 August 2016

Our New App

I've been banging on about our new app for a while but it genuinely is just around the corner.

And we're really excited about it... for a number of reasons.

But mostly because our app is not just a pretty face, it serves a genuine purpose which should make your life as a business owner easier... and, if I'm entirely honest it'll make our lives easier, too.

So, I (kind of) hear you ask - what's so useful about your blog?

Well, apart from all the other stuff you usually get on apps from accountants - things like a directory so you can get in touch with us really easily, fabulous pictures of the team, some documents and an outline of the tax year... I can hear you all glazing over from here.

Apart from all that there's a really neat Expenses function.

The Expenses function allows you to do a couple of things.

Firstly you can record expenses... the app allows you to make a note of the amount and categorise the expense. You can then take a photo of the receipt and get rid of it.

Secondly, you can record your mileage. Just put in your start location, destination and whether it's a round trip or a trip with multiple stops and click a button.

Okay - all well and good. But here's the really good bit.

Every month you can hit a button and our app wraps up all your expenses, turns them into a spreadsheet, attaches the photos of your receipts and emails them to us.

And you can do the same with your monthly mileage claim.

But now for the quid pro quo - the bit that makes our lives just a bit easier... but only if you're on QuickBooks (our cloud based bookkeeping package).

The spreadsheet we get from your app is already configured so we can directly upload to QuickBooks.

That means a couple of things - we can get information to you quicker and more efficiently. In turn this means you can be better prepared for whatever your finances throw at you.

The second thing is that we are starting to make the collection of information from you easier and easier - something we're really keen to do.

Now to the rub... we need something from you!

We're actually looking for 10 volunteers to download the app and use it and report back on how they find it. It should be too onerous, just tell us really briefly what works, what doesn't and what else you'd like to see.

If you'd like to be a Guinea Pig, just email richardlambert@taxassist.co.uk and he'll do the rest.

And we're really excited about it... for a number of reasons.

But mostly because our app is not just a pretty face, it serves a genuine purpose which should make your life as a business owner easier... and, if I'm entirely honest it'll make our lives easier, too.

So, I (kind of) hear you ask - what's so useful about your blog?

Well, apart from all the other stuff you usually get on apps from accountants - things like a directory so you can get in touch with us really easily, fabulous pictures of the team, some documents and an outline of the tax year... I can hear you all glazing over from here.

Apart from all that there's a really neat Expenses function.

The Expenses function allows you to do a couple of things.

Firstly you can record expenses... the app allows you to make a note of the amount and categorise the expense. You can then take a photo of the receipt and get rid of it.

Secondly, you can record your mileage. Just put in your start location, destination and whether it's a round trip or a trip with multiple stops and click a button.

Okay - all well and good. But here's the really good bit.

Every month you can hit a button and our app wraps up all your expenses, turns them into a spreadsheet, attaches the photos of your receipts and emails them to us.

And you can do the same with your monthly mileage claim.

But now for the quid pro quo - the bit that makes our lives just a bit easier... but only if you're on QuickBooks (our cloud based bookkeeping package).

The spreadsheet we get from your app is already configured so we can directly upload to QuickBooks.

That means a couple of things - we can get information to you quicker and more efficiently. In turn this means you can be better prepared for whatever your finances throw at you.

The second thing is that we are starting to make the collection of information from you easier and easier - something we're really keen to do.

Now to the rub... we need something from you!

We're actually looking for 10 volunteers to download the app and use it and report back on how they find it. It should be too onerous, just tell us really briefly what works, what doesn't and what else you'd like to see.

If you'd like to be a Guinea Pig, just email richardlambert@taxassist.co.uk and he'll do the rest.

Wednesday 27 July 2016

Celebrity Friends...

I have a stupid and ridiculous but still pathological aversion to 'celebrity'.

You know the sort of thing I mean; Rylan (is that how you spell it?) who was on the X Factor a couple of years ago. He's what I would call a celebrity: but why? When all is said and done, he's a celebrity for being a rubbish singer... albeit, he's still a better singer than me.

But then again, I'm not a celebrity.

There's no rhyme nor reason to my aversion - I've never met Rylan or any other celebrity for that matter - and he might well be a perfectly nice bloke. In fact he probably is...

It's just that to me, there's no substance, just ambition.

I don't know where my aversion comes from, either. But I can remember when it first manifested itself.

I used to work for a high street bank that shall remain nameless, but listened very well. My second branch was in a city that had a quite a big football club (which will also remain nameless for reasons that will become obvious in a little bit) in the old first division before the days of the Premier League.

My job was on the front desk dealing with all sorts of queries and questions; everything from what's my balance to can I have a loan.

Anyway, one day two famous footballers came in with their attendant WAGs. I recognised them straight away but decided, for whatever reason, to keep stum.

One of the footballers swaggered (yes, swaggered) up to the front desk.

'Are my wages in?' He demanded in a particularly demanding voice.

On the inside I bristled. But on the outside I was very calm.

'I'll check for you... what's your name and who do you work for?'

His eye brows shot up and his footballer friend (whom I also recognised as an international player started laughing.

Anyway, player one told me his name and gave me his employer... saying it as though I should know it (which I did) just because he was a famous footballer.

Now it was my turn to ham it up.

'Really?' Says I, 'you work at the football club? Do you know any of the players?'

Hah, slam dunk, right between the eyes and victory was mine. His colleague was now properly laughing and the WAGs were waving their shoulder pads at me in annoyance.

Then I checked his wages.

Three wins and a draw in a month, played in every game, scored in two of them.

Even back in 1988 his month's wages amounted to... £28,000

Blast.

Now, don't get me wrong, I strongly believe that if someone can command a high salary because of what they do whether they save lives, create jobs or they entertain millions, that's all well and good... I begrudge no-one their salary.

But please, please can we back up ambition with talent before we celebrate celebrity?

You know the sort of thing I mean; Rylan (is that how you spell it?) who was on the X Factor a couple of years ago. He's what I would call a celebrity: but why? When all is said and done, he's a celebrity for being a rubbish singer... albeit, he's still a better singer than me.

But then again, I'm not a celebrity.

There's no rhyme nor reason to my aversion - I've never met Rylan or any other celebrity for that matter - and he might well be a perfectly nice bloke. In fact he probably is...

It's just that to me, there's no substance, just ambition.

I don't know where my aversion comes from, either. But I can remember when it first manifested itself.

I used to work for a high street bank that shall remain nameless, but listened very well. My second branch was in a city that had a quite a big football club (which will also remain nameless for reasons that will become obvious in a little bit) in the old first division before the days of the Premier League.

My job was on the front desk dealing with all sorts of queries and questions; everything from what's my balance to can I have a loan.

Anyway, one day two famous footballers came in with their attendant WAGs. I recognised them straight away but decided, for whatever reason, to keep stum.

One of the footballers swaggered (yes, swaggered) up to the front desk.

'Are my wages in?' He demanded in a particularly demanding voice.

On the inside I bristled. But on the outside I was very calm.

'I'll check for you... what's your name and who do you work for?'

His eye brows shot up and his footballer friend (whom I also recognised as an international player started laughing.

Anyway, player one told me his name and gave me his employer... saying it as though I should know it (which I did) just because he was a famous footballer.

Now it was my turn to ham it up.

'Really?' Says I, 'you work at the football club? Do you know any of the players?'

Hah, slam dunk, right between the eyes and victory was mine. His colleague was now properly laughing and the WAGs were waving their shoulder pads at me in annoyance.

Then I checked his wages.

Three wins and a draw in a month, played in every game, scored in two of them.

Even back in 1988 his month's wages amounted to... £28,000

Blast.

Now, don't get me wrong, I strongly believe that if someone can command a high salary because of what they do whether they save lives, create jobs or they entertain millions, that's all well and good... I begrudge no-one their salary.

But please, please can we back up ambition with talent before we celebrate celebrity?

Wednesday 13 July 2016

Booking.com

Don't get me wrong... I really like booking.com.

I like the way the website and App interact with each other and with me... I like the way the booking process works and I even like the (pretty constant) suggestions of places I might like to visit.

And I certainly like the prices.

For example, I've been doing a bit of work in London recently. My work has been based near the Royal Albert Hall and, as you can imagine finding somewhere to stay nearby was proving to be, shall we say, pricey.

So, booking.com to the rescue.

It took a bit of searching but I eventually found what looked like a very nice four star hotel called the Park Grand in Bayswater, just the other side of Hyde Park - a pleasant 20 minute walk from where I was working.

And, even better, it was 50% off on booking.com. Now, I have to say that didn't make the single room I booked exactly cheap, but at least it was a realistic £100 a night instead of the advertised £200.

I fetched up on Sunday evening at the hotel and experienced booking.comism for the first time.

It's a bit like sexism but funny rather than simply wrong.

First of all checking was fine and I was allocated room 019... 'round the corner to the lift, sir'.

So I went to the lift and went up.

First mistake.

I walked back down to the ground floor and kept following the signs - down into the basement. And there I found room 019. I have to say it had everything a room should have. A wardrobe, single bed, desk and shower room.

But no floor space... almost literally. I could stretch my arms out and touch both walls... but, okay; after all I was really only going to sleep in the room. It was comfortable enough.

I went back to reception to check what time breakfast was in the morning. But it occurred to me to ask: 'does my room come with breakfast included?'

The same guy who checked me simply looked me straight in the eye and said:

'Booking.com. No, sir'.

I like the way the website and App interact with each other and with me... I like the way the booking process works and I even like the (pretty constant) suggestions of places I might like to visit.

And I certainly like the prices.

For example, I've been doing a bit of work in London recently. My work has been based near the Royal Albert Hall and, as you can imagine finding somewhere to stay nearby was proving to be, shall we say, pricey.

So, booking.com to the rescue.

It took a bit of searching but I eventually found what looked like a very nice four star hotel called the Park Grand in Bayswater, just the other side of Hyde Park - a pleasant 20 minute walk from where I was working.

And, even better, it was 50% off on booking.com. Now, I have to say that didn't make the single room I booked exactly cheap, but at least it was a realistic £100 a night instead of the advertised £200.

I fetched up on Sunday evening at the hotel and experienced booking.comism for the first time.

It's a bit like sexism but funny rather than simply wrong.

First of all checking was fine and I was allocated room 019... 'round the corner to the lift, sir'.

So I went to the lift and went up.

First mistake.

I walked back down to the ground floor and kept following the signs - down into the basement. And there I found room 019. I have to say it had everything a room should have. A wardrobe, single bed, desk and shower room.

But no floor space... almost literally. I could stretch my arms out and touch both walls... but, okay; after all I was really only going to sleep in the room. It was comfortable enough.

I went back to reception to check what time breakfast was in the morning. But it occurred to me to ask: 'does my room come with breakfast included?'

The same guy who checked me simply looked me straight in the eye and said:

'Booking.com. No, sir'.

Thursday 30 June 2016

A funny old time...

It's a funny old time in business at the moment...

What with the Brexit* vote and the potential for (yet another) referendum, this time for Scottish Independence, there's quite a lot going on.

And, it seems to me, there are a lot of people, mostly politicians - all of whom are an awful lot smarter than me, talking about uncertain times ahead.

But I don't see it.

This is my philosophy on things:

No matter what happens the sun will come up tomorrow (although it might be behind some cloud) and it will go down again at the end of the day. That's certain.

And, do you know what?: people are still going to need their haircut and to have a cup of coffee on their way to work. They need their front rooms decorated and their showers fixed. They need new carpets and their cars still need an MoT.

Who knows what will happen in the political world tomorrow? I for one have decided not to worry about it and I'm not going to think about what might happen if this or that occurs because that way will only lead to more uncertainty. And my uncertainty won't help anyone I know.

I truly believe that how these days pan out is down to us - us who work in small businesses delivering service, building things and doing things for customers day in day out.

Why do I think like this?

Well, I'm lucky enough to meet lots of people doing lots of things in business. We have every business you could think of as clients from scientists to builders and singers to tailors. And there's business out there for everyone. I've heard 'experts' predict that there might be 15% fall in business (whatever that means).

I don't believe that but even if there was, it means 85% of business is still being done.

So, let's just stop talking about uncertainty and get on with doing business and it will be better for everyone.

I've got another idea. Let's build a big wall (at least a metaphorical one) around politics and let them think the big thoughts, talk about things endlessly and worry about uncertainty whilst we just crack on with things.

But then, I guess that's we always do isn't it?

As a final point, I would say that I know my view is overly simplistic but simple is good sometimes.

*I've been trying to find relevant and useful information on Brexit and what it means definitively... And I can't find anything. That's because it doesn't exist. No-one knows what it means so I can't help thinking we can create anything we want out of this situation.

What with the Brexit* vote and the potential for (yet another) referendum, this time for Scottish Independence, there's quite a lot going on.

And, it seems to me, there are a lot of people, mostly politicians - all of whom are an awful lot smarter than me, talking about uncertain times ahead.

But I don't see it.

This is my philosophy on things:

No matter what happens the sun will come up tomorrow (although it might be behind some cloud) and it will go down again at the end of the day. That's certain.

And, do you know what?: people are still going to need their haircut and to have a cup of coffee on their way to work. They need their front rooms decorated and their showers fixed. They need new carpets and their cars still need an MoT.

Who knows what will happen in the political world tomorrow? I for one have decided not to worry about it and I'm not going to think about what might happen if this or that occurs because that way will only lead to more uncertainty. And my uncertainty won't help anyone I know.

I truly believe that how these days pan out is down to us - us who work in small businesses delivering service, building things and doing things for customers day in day out.

Why do I think like this?

Well, I'm lucky enough to meet lots of people doing lots of things in business. We have every business you could think of as clients from scientists to builders and singers to tailors. And there's business out there for everyone. I've heard 'experts' predict that there might be 15% fall in business (whatever that means).

I don't believe that but even if there was, it means 85% of business is still being done.

So, let's just stop talking about uncertainty and get on with doing business and it will be better for everyone.

I've got another idea. Let's build a big wall (at least a metaphorical one) around politics and let them think the big thoughts, talk about things endlessly and worry about uncertainty whilst we just crack on with things.

But then, I guess that's we always do isn't it?

As a final point, I would say that I know my view is overly simplistic but simple is good sometimes.

*I've been trying to find relevant and useful information on Brexit and what it means definitively... And I can't find anything. That's because it doesn't exist. No-one knows what it means so I can't help thinking we can create anything we want out of this situation.

Tuesday 14 June 2016

Time

I live in Edinburgh...

And life is pretty fast paced.

I get into work about 9 in the morning. I look at my watch and it's 5 to 1 - lunch time. I look again and its quarter past 5. I look for a final time and it's 7.30.

Every day is like that, without fail. Even the weekends go by in a flash and I certainly can't believe that it's the middle of June - the year only just seems to have got going and I'm thinking about booking the team's Christmas dinner!

Has anyone else noticed how life seems to be going by faster and faster? I've worked out exactly why this happens.

Think about this.

When you are 10 years old - 1 year of your life equals 10% of the time you've been alive - a big proportion.

But when you're 50 (which I virtually am) 1 year of your life represents only 2% of the total - hence it goes by a lot quicker.

I said to Renee last year (2015) 'time is flashing by so quickly - 2014 went by in a blur. We really need to slow 2015 down.'

She just looked at me with a withering stare, shook her head and said, 'You idiot... it's November!'

Fair point.

Anyway, to the point of this blog.

Last week Renee and I went to visit my Mum and Dad who live in a little place called Oulton Broad in Suffolk... Oulton Broad is the only Norfolk Broad that's not actually in Norfolk.

We arrived Monday evening and by Tuesday afternoon we'd noticed something very strange.

Time was moving much slower.

I got up about 8 and a bit later I looked at my watch. It was only half past 9. In Edinburgh it would have been 1pm.

We went walking, walked for hours along the banks of the River Waveney and still arrived in Beccles before lunch.

I looked at my watch later in the evening: 9pm!

How could this be? Is there some time shift somewhere around King's Lynn? After all, it can't be anything to do with having time off because Saturdays in Edinburgh flash by just as fast as a week day!

So what is it?

And can it be bottled for later?

Because I sure as eggs are eggs know that I need to slow down time some how.

Any suggestions?

And life is pretty fast paced.

I get into work about 9 in the morning. I look at my watch and it's 5 to 1 - lunch time. I look again and its quarter past 5. I look for a final time and it's 7.30.

Every day is like that, without fail. Even the weekends go by in a flash and I certainly can't believe that it's the middle of June - the year only just seems to have got going and I'm thinking about booking the team's Christmas dinner!

Has anyone else noticed how life seems to be going by faster and faster? I've worked out exactly why this happens.

Think about this.

When you are 10 years old - 1 year of your life equals 10% of the time you've been alive - a big proportion.

But when you're 50 (which I virtually am) 1 year of your life represents only 2% of the total - hence it goes by a lot quicker.

I said to Renee last year (2015) 'time is flashing by so quickly - 2014 went by in a blur. We really need to slow 2015 down.'

She just looked at me with a withering stare, shook her head and said, 'You idiot... it's November!'

Fair point.

Anyway, to the point of this blog.

Last week Renee and I went to visit my Mum and Dad who live in a little place called Oulton Broad in Suffolk... Oulton Broad is the only Norfolk Broad that's not actually in Norfolk.

We arrived Monday evening and by Tuesday afternoon we'd noticed something very strange.

Time was moving much slower.

I got up about 8 and a bit later I looked at my watch. It was only half past 9. In Edinburgh it would have been 1pm.

We went walking, walked for hours along the banks of the River Waveney and still arrived in Beccles before lunch.

I looked at my watch later in the evening: 9pm!

How could this be? Is there some time shift somewhere around King's Lynn? After all, it can't be anything to do with having time off because Saturdays in Edinburgh flash by just as fast as a week day!

So what is it?

And can it be bottled for later?

Because I sure as eggs are eggs know that I need to slow down time some how.

Any suggestions?

Let Property Campaign

Whatever we think of HMRC, bless them, I have to say I believe they are entirely fair.

At least they have been in my dealings with them.

A little black and white, maybe, but entirely fair nonetheless.

A little bit difficult to deal with, sometimes, but entirely fair.

A little intransigent, I grant you, but entirely fair.

That's why I'm a bit surprised at the HMRC Let Property Campaign (LPC). A whole unit has been set up within HMRC to make the campaign run smoothly and in my dealings with them they have been excellent.

Just to recap what the LPC is all about.

Some people own a second property which they let out to tenants. They receive rent from their tenant and if the income received is more than the allowable expenses they make a profit. This profit is taxed... as long as HMRC knows about it.

That's why, with a very few exceptions, everyone who rents out a property needs to fill in a self assessment tax return every year to declare this profit.

However, for whatever reason, some people don't do this. They've forgotten they have the property, they don't think they need to fill in a tax return, the dog ate it and so on...

And once a tax return is missed one year and the world doesn't come to an end, the following year it's just a little easier not to complete a return and the next year is easier still.

All of a sudden 10 years have been missed and now the weight of guilt begins to build up. The person in question is just waiting for the letter, the 'phone call or even the visit (very unlikely) from HMRC to say 'you're nicked, mate'.

But all HMRC wants, being entirely fair, is everyone to pay the tax they are due and so the Let Property Campaign was born to make it easy for landlords to bring their affairs up to date (to quote the website).

There are two ways the campaign works. A landlord can 'fess up' and get in touch with the campaign to say they have a property and they want to take part in the campaign.

Or...

HMRC gets wind of the property and writes to the landlord with a reference number and inviting them to come clean. And, by the way, if you have a property you haven't declared this is getting more and more likely as the landlord registration scheme really kicks in.

Option 1 (fessing up voluntarily) is preferable from a fines point of view but in either case the process is simple enough: work out what level of profit you made by renting out the property over however many years you've had it, select the level of penalty you believe you should pay, work out the interest that's due and make an offer to HMRC.

They'll check your figures and either say 'yes' or 'no' depending on whether they believe you.

Once they agree and you pay everything becomes formal and that's it.

You get to sleep easy again.

We've completed quite a few of these now for a customers and we do all the negotiation with HMRC and even fill in the forms.

If you need any help or even just want to talk through your options, get in touch: 0131 202 9888 or via Facebook:

facebook.com/accountantsedinburgh

Thursday 2 June 2016

Techno Wizard...

... I ain't.

But techophobe neither.

I sit somewhere slap bang in the middle. I like technology for what it can do but not for technology's sake if you see what I mean. I need someone to tell me what's possible...

Let me give you an example.

I was at a networking event several years ago and I was talking to an IT guy. Unfortunately I'd exhausted the subjects of weather, football, politics and quantum physics so I thought I'd better ask him something about IT.

As I said this was a few years back so the I-Pad had been about for a while but wasn't very widespread yet. This is what I heard myself saying:

'I can't really see the point of an I-Pad, can you?'

This was the response I got:

'Your I-Pad will occupy the space between your I-Phone and your laptop.'

'Uh-huh? Really?' Says I nodding wisely and wondering what possible response to give because I wasn't actually aware of the space between my I-Phone and my laptop. 'Is there a space between..?'

'Oh, yes,' says the IT guy before wandering off, clearly bored with my conversation.

The next week I was away working. And, along with many sad gits I was having breakfast on my own in the hotel restaurant. I didn't want to just stare into space whilst waiting for my eggs so I was watching the news on my I-Phone when I looked around at my fellow saddos.

And lo and behold they were watching the news, too... but on their I-Pads. There was a space between I-Phone and laptop after all!

Up to date now - well, a few months ago...

I had the thought that we need to move with the times and have our own app...

And I was asked the inevitable question by my co-directors: 'Why?'

Errmmm... to improve client engagement and facilitate the transfer of information (I seemed to remember from the blurb the app development company sent to me.)

There was a sad shaking of the heads and a very quiet moment...

But after a while as we started thinking about what our own app would look like we found the reason to have one and started the ball rolling.

I am delighted to tell you that our very own app is going to be launched in a few weeks.

It will allow us to chase people for records, send information that will be useful and relevant, tell people about us... but it will also keep track of mileage claims and expenses, sending the info to us at regular intervals.

More details to follow - but we're excited about this one!

But techophobe neither.

I sit somewhere slap bang in the middle. I like technology for what it can do but not for technology's sake if you see what I mean. I need someone to tell me what's possible...

Let me give you an example.

I was at a networking event several years ago and I was talking to an IT guy. Unfortunately I'd exhausted the subjects of weather, football, politics and quantum physics so I thought I'd better ask him something about IT.

As I said this was a few years back so the I-Pad had been about for a while but wasn't very widespread yet. This is what I heard myself saying:

'I can't really see the point of an I-Pad, can you?'

This was the response I got:

'Your I-Pad will occupy the space between your I-Phone and your laptop.'

'Uh-huh? Really?' Says I nodding wisely and wondering what possible response to give because I wasn't actually aware of the space between my I-Phone and my laptop. 'Is there a space between..?'

'Oh, yes,' says the IT guy before wandering off, clearly bored with my conversation.

The next week I was away working. And, along with many sad gits I was having breakfast on my own in the hotel restaurant. I didn't want to just stare into space whilst waiting for my eggs so I was watching the news on my I-Phone when I looked around at my fellow saddos.

And lo and behold they were watching the news, too... but on their I-Pads. There was a space between I-Phone and laptop after all!

Up to date now - well, a few months ago...

I had the thought that we need to move with the times and have our own app...

And I was asked the inevitable question by my co-directors: 'Why?'

Errmmm... to improve client engagement and facilitate the transfer of information (I seemed to remember from the blurb the app development company sent to me.)

There was a sad shaking of the heads and a very quiet moment...

But after a while as we started thinking about what our own app would look like we found the reason to have one and started the ball rolling.

I am delighted to tell you that our very own app is going to be launched in a few weeks.

It will allow us to chase people for records, send information that will be useful and relevant, tell people about us... but it will also keep track of mileage claims and expenses, sending the info to us at regular intervals.

More details to follow - but we're excited about this one!

Tuesday 31 May 2016

Buy1Give1

I guess very few experiences are genuinely life changing.

Sometimes we go through an event and it changes our attitude to something, or we enjoy (or hate) something so much we decide to do more (or less) of it in the future...

But rarely does something affect us so profoundly that everything changes.

I actually had one of those experiences in April at the ActionCOACH Business Excellence Forum conference.

Generally speaking the conference was great with lots of inspirational and motivational speakers with brilliant business ideas. I came back with a notebook full of them and some of them I've even acted upon.

But there was one speaker, called Paul Dunn, who talked about things guys at these conferences tend to talk about. Things like making lots of small changes instead of trying to make whacking great big ones and so on...

But then he started talking about a... I hardly know how to describe it... a movement he's involved with called Buy1Give1. Sometimes shortened to B - 1 - G -1. Not Bigi as someone once said!.

Buy1Give1 struck a chord with all three of us directors and I think it made an impact for different reasons.

For me giving to charity is a complicated thing (in my mind). After all, who do you give to, how much and how do you know it gets to the right place? I occasionally will text in a donation in response to a TV advert but I'm put off doing this by the telephone calls that inevitably follow and I usually give something at Children In Need time.

For me, though, B1G1 gives us as a business a fantastic opportunity to make impacts which we control. We control how much we spend and it's amazing how a few dollars can make huge impacts on peoples' lives when given in the right way.

For Renee, I think it was to do with the fact that B1G1 gives us a reason to create impacts and as we create more impacts we build stories that we can share... (and please note the language - it's not about giving to charity, it's about impacting someone's life).

For Rowena it was more about the opportunity to include the team, to provide them with budgets and opportunities to make impacts by contributing to one of many, many projects there are available.

B1G1 makes it very easy for me to have an impact on someone's life who hasn't been as fortunate as I have. It also gives me a reason and a way of doing it regularly, quietly and in a small way without the need or requirement for a grand gesture.

And I like that.

It's not for everyone but if you'd like to see how it works visit www.b1g1.com

Thank you.

Sometimes we go through an event and it changes our attitude to something, or we enjoy (or hate) something so much we decide to do more (or less) of it in the future...

But rarely does something affect us so profoundly that everything changes.

I actually had one of those experiences in April at the ActionCOACH Business Excellence Forum conference.

Generally speaking the conference was great with lots of inspirational and motivational speakers with brilliant business ideas. I came back with a notebook full of them and some of them I've even acted upon.

But there was one speaker, called Paul Dunn, who talked about things guys at these conferences tend to talk about. Things like making lots of small changes instead of trying to make whacking great big ones and so on...

But then he started talking about a... I hardly know how to describe it... a movement he's involved with called Buy1Give1. Sometimes shortened to B - 1 - G -1. Not Bigi as someone once said!.

Buy1Give1 struck a chord with all three of us directors and I think it made an impact for different reasons.

For me giving to charity is a complicated thing (in my mind). After all, who do you give to, how much and how do you know it gets to the right place? I occasionally will text in a donation in response to a TV advert but I'm put off doing this by the telephone calls that inevitably follow and I usually give something at Children In Need time.

For me, though, B1G1 gives us as a business a fantastic opportunity to make impacts which we control. We control how much we spend and it's amazing how a few dollars can make huge impacts on peoples' lives when given in the right way.

For Renee, I think it was to do with the fact that B1G1 gives us a reason to create impacts and as we create more impacts we build stories that we can share... (and please note the language - it's not about giving to charity, it's about impacting someone's life).

For Rowena it was more about the opportunity to include the team, to provide them with budgets and opportunities to make impacts by contributing to one of many, many projects there are available.

B1G1 makes it very easy for me to have an impact on someone's life who hasn't been as fortunate as I have. It also gives me a reason and a way of doing it regularly, quietly and in a small way without the need or requirement for a grand gesture.

And I like that.

It's not for everyone but if you'd like to see how it works visit www.b1g1.com

Thank you.

Tuesday 26 January 2016

Corporate Difficulties

I try not to rant too much in these blogs but my unwritten rule is about to be broken.

I shan't name names unless you force me to but you won't be able to get anyO2thing from me.

Whatever you say won't make me Talk Talk, it doesn't matter how Hot your Point is you just won't be able to make me Volvo. Did I say Volvo? I meant talk.

So, we got new 'phones recently and as part of the deal I had to send the old 'phones back... which I did in the bags provided.

I then got a letter saying that if I didn't send the 'phones back my account would be debited with £661. Of course, I rang to complain and the guy at the nameless 'phone company said 'nope, the 'phones had arrived and all was okay.'

The next letter to arrive said they had our 'phones and would be charging me £52.50 for damage to a case. Fair enough - there was a dent and a chip.

Then I checked my bank account and £661 had been debited.

So, of course, I called. There was a profuse apology and a promise to refund me £661. Immediately? No. In 10 to 15 days. Working days!

How is that fair?

But then I suddenly thought to myself 10 days later that I hadn't had the refund... except I had - my O2 (ooops - there, I've spilled the beans) account had been credited but I should have been told that I had to call again to get my bank account refunded.

I asked for the refund - guess how long before I'll get it.

Yep... you're quite right. Another 10 to 15 days! O2 could have my money - more than £600 - for nearly a month... and they took it incorrectly. Some would say 'stole'... but not me of course. Just some.

Talk about incensed.

And talk about Talk Talk.

I got an email that said I was moving out of my house and other people were moving in and didn't want Talk Talk anymore.

First I'd heard of it - I ain't moving and I hadn't been in touch with said company. Could it be anything to do with data being stolen and other companies taking advantage?

Just asking.

So, I called. The first two people clearly didn't understand:

'So, you wanted to leave Talk Talk and now you've changed your mind..?'

'No, I never wanted to leave in the first place.'

'But it says on our system that we have a termination request.'

'Well it didn't come from me.'

'Who did it come from then?'

'How the bloody hell should I know?'

'Please don't use offensive language...'

The third person said they'd sort it, which I didn't believe and lo and behold a letter turned up on Saturday saying our service would be terminated on 29th January.

So, another 'phone call which, to be fair, seemed to sort things.

I just wouldn't try to call me at home on the 29th January - just to be on the safe side, you understand!

I shan't name names unless you force me to but you won't be able to get anyO2thing from me.

Whatever you say won't make me Talk Talk, it doesn't matter how Hot your Point is you just won't be able to make me Volvo. Did I say Volvo? I meant talk.

So, we got new 'phones recently and as part of the deal I had to send the old 'phones back... which I did in the bags provided.

I then got a letter saying that if I didn't send the 'phones back my account would be debited with £661. Of course, I rang to complain and the guy at the nameless 'phone company said 'nope, the 'phones had arrived and all was okay.'

The next letter to arrive said they had our 'phones and would be charging me £52.50 for damage to a case. Fair enough - there was a dent and a chip.

Then I checked my bank account and £661 had been debited.

So, of course, I called. There was a profuse apology and a promise to refund me £661. Immediately? No. In 10 to 15 days. Working days!

How is that fair?

But then I suddenly thought to myself 10 days later that I hadn't had the refund... except I had - my O2 (ooops - there, I've spilled the beans) account had been credited but I should have been told that I had to call again to get my bank account refunded.

I asked for the refund - guess how long before I'll get it.

Yep... you're quite right. Another 10 to 15 days! O2 could have my money - more than £600 - for nearly a month... and they took it incorrectly. Some would say 'stole'... but not me of course. Just some.

Talk about incensed.

And talk about Talk Talk.

I got an email that said I was moving out of my house and other people were moving in and didn't want Talk Talk anymore.

First I'd heard of it - I ain't moving and I hadn't been in touch with said company. Could it be anything to do with data being stolen and other companies taking advantage?

Just asking.

So, I called. The first two people clearly didn't understand:

'So, you wanted to leave Talk Talk and now you've changed your mind..?'

'No, I never wanted to leave in the first place.'

'But it says on our system that we have a termination request.'

'Well it didn't come from me.'

'Who did it come from then?'

'How the bloody hell should I know?'

'Please don't use offensive language...'

The third person said they'd sort it, which I didn't believe and lo and behold a letter turned up on Saturday saying our service would be terminated on 29th January.

So, another 'phone call which, to be fair, seemed to sort things.

I just wouldn't try to call me at home on the 29th January - just to be on the safe side, you understand!

Wednesday 20 January 2016

Feeling Good

I've never found someone's wallet lying on the pavement... until today, that is.

I was walking Barney down to the office about lunchtime (and I know what you're thinking when I say that - but I wasn't skiving) and there it was.

Just laying in the middle of the pavement, with plastic cards scattered about it.

The mix of emotions I felt when I saw took me completely by surprise.

My first thought was: what a pain, I need to do something about this.

My second thought was guilt as I picked up the wallet... in case someone thought I was half inching it and my third thought, when I saw the family photographs was 'poor bloke'.

But once you've picked up a wallet, what do you do with it? It felt wrong to put it in my pocket but what else was I supposed to do?

I looked round in vain for someone to hand the problem off to... if only there was a passing police officer I could give it to. But there was no-one. Government cuts you see; there just aren't the same number of Bobbies on the beat as there used to be.

So I tried the shop outside which I found the wallet.

Nope, they didn't know who it was either.

There was only one thing for it; I was going to have to go through the wallet to look for some kind of contact details (more guilt at doing that) and lo and behold there was a business card for a local car dealership.

So I rang it on the off chance and got a lucky break: the guy was a customer of theirs. The receptionist left a 'phone message for him and an hour later he called me. Half an hour after that he came to the office and collected his wallet.

As I thought, it was the pictures of his wife with their grandson that he was most worried about losing but all's well that ends well and bloke and wallet were reunited.

And then I thought - what kind of muppet am I that a) my first thought was 'what I pain, I need to do something about this' and b) I felt guilty for picking up the wallet in the first place in case someone thought I was nicking it?

But, there you are... even being a muppet doesn't necessarily stop good things from happening.

I was walking Barney down to the office about lunchtime (and I know what you're thinking when I say that - but I wasn't skiving) and there it was.

Just laying in the middle of the pavement, with plastic cards scattered about it.

The mix of emotions I felt when I saw took me completely by surprise.

My first thought was: what a pain, I need to do something about this.

My second thought was guilt as I picked up the wallet... in case someone thought I was half inching it and my third thought, when I saw the family photographs was 'poor bloke'.

But once you've picked up a wallet, what do you do with it? It felt wrong to put it in my pocket but what else was I supposed to do?

I looked round in vain for someone to hand the problem off to... if only there was a passing police officer I could give it to. But there was no-one. Government cuts you see; there just aren't the same number of Bobbies on the beat as there used to be.

So I tried the shop outside which I found the wallet.

Nope, they didn't know who it was either.

There was only one thing for it; I was going to have to go through the wallet to look for some kind of contact details (more guilt at doing that) and lo and behold there was a business card for a local car dealership.

So I rang it on the off chance and got a lucky break: the guy was a customer of theirs. The receptionist left a 'phone message for him and an hour later he called me. Half an hour after that he came to the office and collected his wallet.

As I thought, it was the pictures of his wife with their grandson that he was most worried about losing but all's well that ends well and bloke and wallet were reunited.

And then I thought - what kind of muppet am I that a) my first thought was 'what I pain, I need to do something about this' and b) I felt guilty for picking up the wallet in the first place in case someone thought I was nicking it?

But, there you are... even being a muppet doesn't necessarily stop good things from happening.

Friday 8 January 2016

Singing Praises

I don't do this very often - perhaps I should do more of it here in our blogs.

But today I am going to be serious (for once) and take the opportunity to sing the praises of two of our team members.

(Although I could do this for every one of our team... it's just there have been two very specific instances recently.)

Farhan joined us a few months ago and has proved to be a brilliant addition to our accounting team. This was really brought home to me on New Year's Eve.

A customer of ours had a deadline to meet which just happened to be 31st December 2015. It wasn't an easy set of accounts and it was a bit of a rush job. There was some info missing from what we needed and all in all it would have been easy for Farhan to say 'you know what... I didn't get everything I needed on time, I'm going home.'

But he didn't.

He completed his background work at about 6.30pm (on New Year's Eve, remember), journalled in the accounts, checked everything and called the customer at 8.30pm asking for permission to file.

All on New Year's Eve...

And what's even more impressive is that he did it all with a smile on his face, communicated with the customers all the way through the process and got the job done.

The accounts were filed within deadline... whilst the customer was at a party!

Brilliant.

The second member of our team I want to thank formally is Arjun.

VAT returns have to be filed by 7th of the month after the end of the VAT quarter... so if your VAT quarter finishes 30th November you have all of December and 7 days of January to file (and pay your VAT bill if there is one).

We spotted we had a customer who hadn't filed their VAT return by about 6.00pm on 7th January... it was an oversight, nothing more, on their part.

Arjun contacted the customer to get their records emailed through, completed the VAT return, got the figure to our customer, filed the return and the customer paid their VAT bill... all within deadline which means for the customer there was no fine and everyone was happy.

Arjun stayed and finished the process, leaving the office at about 9.30pm. This is what the customer wrote to him:

'Hi Arjun, you are incredibly kind doing this for me tonight. I have just paid the outstanding via my online banking so that is great. I owe you guys for this. Have a good night also and thank you very much again. Cheers.'

Arjun's reply was priceless. I love it and will keep it forever because it's exactly how we operate, it's our ethos and what we strive to be and do for everyone. Here it is:

'Not a problem at all, XXX. Pleasure is all mine. That's why we are different at TaxAssist.

Good night.'

But today I am going to be serious (for once) and take the opportunity to sing the praises of two of our team members.

(Although I could do this for every one of our team... it's just there have been two very specific instances recently.)

Farhan joined us a few months ago and has proved to be a brilliant addition to our accounting team. This was really brought home to me on New Year's Eve.

A customer of ours had a deadline to meet which just happened to be 31st December 2015. It wasn't an easy set of accounts and it was a bit of a rush job. There was some info missing from what we needed and all in all it would have been easy for Farhan to say 'you know what... I didn't get everything I needed on time, I'm going home.'

But he didn't.

He completed his background work at about 6.30pm (on New Year's Eve, remember), journalled in the accounts, checked everything and called the customer at 8.30pm asking for permission to file.

All on New Year's Eve...

And what's even more impressive is that he did it all with a smile on his face, communicated with the customers all the way through the process and got the job done.

The accounts were filed within deadline... whilst the customer was at a party!

Brilliant.

The second member of our team I want to thank formally is Arjun.

VAT returns have to be filed by 7th of the month after the end of the VAT quarter... so if your VAT quarter finishes 30th November you have all of December and 7 days of January to file (and pay your VAT bill if there is one).

We spotted we had a customer who hadn't filed their VAT return by about 6.00pm on 7th January... it was an oversight, nothing more, on their part.

Arjun contacted the customer to get their records emailed through, completed the VAT return, got the figure to our customer, filed the return and the customer paid their VAT bill... all within deadline which means for the customer there was no fine and everyone was happy.

Arjun stayed and finished the process, leaving the office at about 9.30pm. This is what the customer wrote to him:

'Hi Arjun, you are incredibly kind doing this for me tonight. I have just paid the outstanding via my online banking so that is great. I owe you guys for this. Have a good night also and thank you very much again. Cheers.'

Arjun's reply was priceless. I love it and will keep it forever because it's exactly how we operate, it's our ethos and what we strive to be and do for everyone. Here it is:

'Not a problem at all, XXX. Pleasure is all mine. That's why we are different at TaxAssist.

Good night.'

Subscribe to:

Posts (Atom)